My son and I will be flying for (nearly) free to Thailand from Madrid next summer, thanks to Capital One Miles.

Capital One Miles have evolved significantly over the last decade or so — they were once a fixed-value currency you could use to deduct travel charges from your bank statement.

Nowadays, you can both earn and redeem these Miles with ease in a variety of ways. In fact, I think they’re one of the most flexible points currencies out there.

Here’s what you need to know to get the most out of them.

In case you missed it...

I stopped chasing airline loyalty. One program changed my mind.My favorite ways to redeem Capital One Miles

I’ve transferred my Capital One Miles to British Airways Executive Club, redeemed them for an emergency hotel stay in Cancun via Capital One Travel when my flight was suddenly canceled, and erased travel charges from my statement for trains and ferries in Thailand.

And thanks to Capital One’s transfer partners, I was able to get one of my favorite award redemptions of all time: I moved 150,000 Miles to Qatar to book two one-way tickets to fly in business class (the luxurious QSuites!) to Thailand at 75,000 Avios per ticket (plus taxes and fees).

Transfer partner basics

Transferring Capital One Miles to partners (namely, ones that transfer at a 1:1) is where you’ll get the best value — up to 2 cents per mile.

You’ll only get a fixed rate of 1 cent per point in Capital One Travel or when erasing travel charges. The flexibility to choose is what I love most about Capital One Miles, but in most cases, transferring them is the most lucrative option.

Capital One Miles transfer to the following transfer partners at a 1:1 ratio:

- Aeromexico Rewards

- Air Canada Aeroplan

- Air France/KLM-Flying Blue

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

When it comes to hotels, you can transfer Capital One Miles to Choice Privileges and Wyndham Rewards at a 1:1 ratio.

And the following Capital One partners have unique transfer ratios:

- Accor Live Limitless (2:1 conversion ratio)

- EVA Air Infinity MileageLands (2:1.5 transfer ratio)

- JetBlue TrueBlue (5:3 transfer ratio)

Other ways to redeem

You can also book hotels, car rentals, flights, and vacation rentals on Capital One Travel. But what sets this currency apart from others is that you can also use Miles to erase travel charges from your statement within 90 days of purchase, including flights, trains, buses, cruises, rideshares, hotels, and even tolls and campground fees.

You can also use Capital One Miles for cash back, gift cards, and to cover Amazon or PayPal purchases. But these options won’t deliver the best value compared with travel redemptions and partner transfers.

Spending hundreds on groceries with nothing to show for it?

The right credit card can transform your weekly supermarket shopping trips into serious rewards. Some offer up to 6% back on groceries, while others provide valuable travel points that can be worth 2-3 times more when redeemed strategically. But here's the game-changer: Many of these cards come with welcome bonuses worth as much as 100,000 points. That's essentially free travel for groceries you're buying anyway. Whether you're feeding a family or shopping solo, there's a card perfectly matched to your spending habits.

Check out our top 5 credit cards for groceriesNow's a great time to start earning

Earning Capital One Miles is easy. Although there are several cards that earn Capital One Miles, one specific card stands out thanks to its current elevated offer: the Capital One Venture Rewards Card.

This card has a reasonable $95 annual fee and is currently offering $250 to use on Capital One Travel in your first cardholder year, plus 75,000 bonus Miles once you spend $4,000 on purchases within the first 3 months from account opening. That's equal to $1,000 in travel (or more, if you use Capital One transfer partners).

Learn how to apply for the Capital One Venture Rewards card

Tip: Don’t forget to take advantage of Capital One Offers, where you can earn additional Miles for paying with your Capital One card at specific retailers.

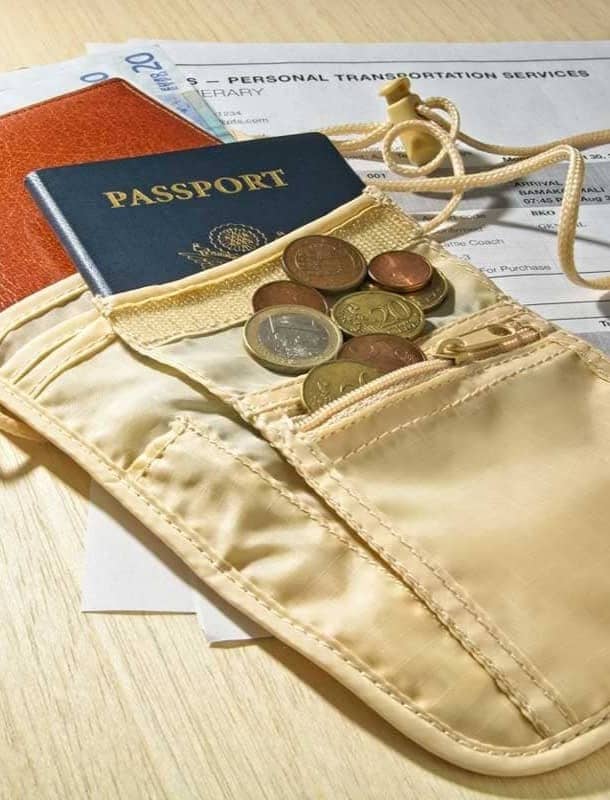

Keep your valuables safe on the road

Make sure your passport, money, and other valuables are always close by with the Boxiki Travel Hidden Money Belt. With its flush-to-the-waist design, this belt bag can be hidden under your clothes, and its RFID-blocking material keeps your personal information safe.

Get it at Amazon