- Get a new travel credit card (or two)

- Earn rewards on rent and mortgage payments

- Sign up for Bilt Neighborhood Benefits

- Connect your Lyft and Uber accounts

- Connect your cards to dining programs

- Always use an online shopping portal

- Activate credit card offers and benefits

- Double-dip on your hotel stays

- Refer your friends for credit cards

- Sign up for every rewards program (and any bonus offers)

- Gear up your miles for 2026

If you haven’t done a points and miles check-in yet this year, now's still a great moment to do it.

With a few simple moves, you could be well on your way to booking your next trip for nearly free. Here are the core moves I rely on each year to boost my rewards — a practical checklist you can work through once and benefit from all year.

Get a new travel credit card (or two)

One of the best — and I mean best — ways to increase your points and miles balance with minimal effort is through credit card bonus offers. A single sign-up bonus can earn 100,000 points or even more.

Even if you feel like you already have a lot of credit cards in your wallet, there's probably room for more, so long as you use them responsibly.

If you're a newbie in the points and miles world, one of the two cards we recommend starting off with is the Chase Sapphire Preferred® Card. With this card, new card holders can earn 75,000 bonus points after spending $5,000 in the first 3 months after opening the account.

The Chase Sapphire Preferred earns flexible points called Ultimate Rewards. These can be used to book travel through Chase's own travel portal (similar to booking through Expedia), or transferred to one of Chase's 14 airline and hotel partners.

The other card we recommend for beginners is the Capital One Venture Rewards Credit Card, which currently comes with 75,000 bonus miles after you spend $4,000 in the first 3 months.

Capital One has more transfer partners, but they're not as easy to use as Chase's. However, the Capital One Venture also allows you to use your miles to wipe away any travel purchase you make with the card, which is about as easy as it gets.

If you're already a pro in the Chase and Capital One ecosystems, you'll want to look into one of the other major flexible points programs: American Express Membership Rewards, Citi ThankYou Rewards, and Bilt Rewards. All of these programs earn flexible points, which means they can be easy to use, or transferred for even more value.

After that, there's a plethora of airline and hotel credit cards, which can also be a great value once you figure out your travel goals.

Earn rewards on rent and mortgage payments

While there are many credit cards that get recommended based on personal spending habits, this one deserves special attention.

With the newly announced Bilt 2.0 program, you'll earn travel points for paying your rent or mortgage on a monthly basis — with no transaction fees. The amount you earn is based on your monthly credit card spend with one of Bilt's three credit cards, ultimately allowing you to earn up to 1.25x points on your housing cost depending on your card tier and monthly spend.

At a first glance, the process can be confusing, but being able to earn points on what's likely to be your biggest monthly expense is quite special.

The Bilt Rewards program is also highly regarded, with a plethora of airline and hotel transfer partners, as well as the option to book through Bilt's own travel portal. With a Bilt credit card in hand, your rent or mortgage payments can truly add up in no time.

In case you missed it...

I didn't expect this $85 travel item to matter so muchSign up for Bilt Neighborhood Benefits

Speaking of Bilt, even if you don't pay your rent or mortgage or have a Bilt credit card, you can still earn Bilt Rewards points in other ways.

With the free Bilt Neighborhood Benefits program, you earn extra points every time you shop at a partner merchant, and you can use any credit card — or even a debit card — linked to your Bilt account. Plus, you'll still earn your regular credit card rewards on top of it all.

Some of the more popular ways to earn points through Bilt Neighborhood Benefits include eating out at local restaurants, shopping at Walgreens, and signing up for a fitness class at participating studios. You can even link your Lyft account to Bilt and earn extra points every time you take a rideshare.

I personally have five credit cards linked to my Bilt account, which means I’m earning Bilt points on everyday spending without changing my card strategy. It’s a simple "set it and forget it" strategy that ends up earning me bonus points each month, often without even realizing it.

Plus, since Bilt points transfer to 23 different airline and hotel partners, there are plenty of ways to put those extra points to good use. You’ll find familiar names like Alaska Airlines, United, Air France/KLM, British Airways, Marriott, Hyatt, and more, making it easy to earn and redeem your rewards across some of the most popular travel programs.

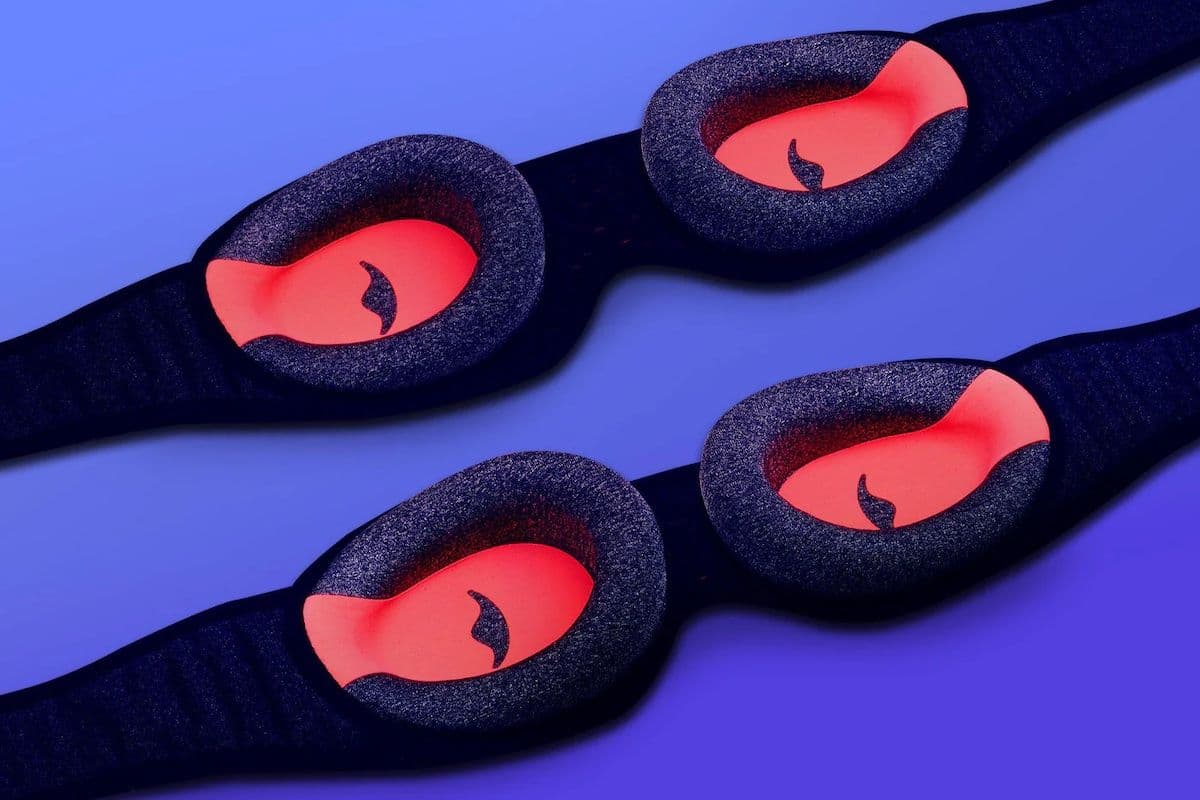

Use your Bluetooth headphones with any airplane seatback screen

While some airlines like Delta and United are beginning to introduce Bluetooth-enabled inflight entertainment systems, widespread adoption is still years away. That means it's nearly impossible to use your own headphones or earbuds with your plane’s seatback screen. Or is it? We’ve found a simple and affordable gadget that plugs into a standard airplane headphone jack and pairs your wireless headphones effortlessly. Whether you're on a long-haul flight or just a short domestic hop, this device ensures a seamless, wire-free audio experience.

Learn how to avoid tangled cords at 30,000 feetConnect your Lyft and Uber accounts

You can earn extra points and miles in many other partner programs when you take a Lyft or Uber. But you'll need to link your accounts in advance.

With Uber, you can earn extra rewards with Delta SkyMiles, Air Canada Aeroplan, Marriott Bonvoy, Air France/KLM Flying Blue, and Qantas Frequent Flyer, while Lyft currently partners with Alaska Airlines Atmos Rewards, Hilton Honors, and Bilt Rewards.

Keep in mind that you can only link one airline or hotel partner per service, so there's no double-dipping rewards. But with either Uber or Lyft, there's no cap on how many points you can earn. So don't leave any rewards on the table during your next "taxi" ride.

Connect your cards to dining programs

By connecting your credit card to a free rewards dining program, you can earn points or miles whenever you eat at participating restaurants.

Just spend a few minutes up front entering your credit card (or cards) into the dining program, and you'll automatically earn bonus points when you dine out at an eligible restaurant.

New members to dining programs can also earn a bonus for signing up and then dining out. Some of our favorites include Delta SkyMiles Dining, American AAdvantage Dining, Alaska Atmos Rewards Dining, United MileagePlus Dining, and Southwest Rapid Rewards Dining.

Always use an online shopping portal

Most everyone shops online these days, and there's a reward for that — the option to earn extra points and miles. But not just the ones that come from using your credit card to pay.

With a free online shopping portal, instead of going directly to the retailer's website, you start at the portal first. From there, you search for your merchant, click through to its website, and then make your purchase as you normally would. The process only takes an extra minute, and the extra points or miles are well worth it.

One of my personal favorites is the Rakuten shopping portal, which lets you choose whether to earn cash back or loyalty rewards, such as American Express Membership Rewards points or Bilt points.

Rakuten is currently offering a $50 bonus to new members.

If you're looking to accrue points or miles with a specific carrier, many airlines also offer their own shopping portals, including American, Delta, United, Alaska, Southwest, and JetBlue. Plus, several times throughout the year, airline shopping portals will offer a bonus for spending a certain amount during a designated timeframe.

And a more recent favorite of mine is Capital One shopping. With incredibly high offers — many times based on your online shopping patterns — you can rack up rewards in no time. For example, on a recent purchase of $833 worth of concert tickets through StubHub, I received $375 back in rewards. The best part: You don't even have to have a Capital One credit card to take advantage of these offers. And new users can receive an $80 bonus just for signing up and using the shopping extension.

Sign up for Rakuten and earn $50 cash back

Sign up for Capital One Shopping and earn an $80 bonus

Activate credit card offers and benefits

Whether you hold one or a dozen credit cards in your wallet, there's a good chance they come with extra perks to help you save money throughout the year. However, these benefits don't typically get automatically applied when meeting the terms, instead you need to activate each and every offer to reap the savings.

Recently, we put together a list of many popular credit card benefits that require enrollment to help you stay on track. This includes many perks, such as dining credits, airline fee credits, and even extra points on quarterly bonus credits.

Many credit cards also include shopping offers where you'll receive cash back or bonus points at select merchants. Two of the most popular ones — Amex Offers and Chase Offers — require you to activate the offer prior to making the purchase as well. Fortunately though, the CardPointers tool can auto-enroll you in these offers, making it easy to take advantage of every money-saving offer there is.

Double-dip on your hotel stays

There’s nothing better than double-dipping on your rewards — and that’s exactly where the AI-powered hotel-booking tool Gondola shines. Hotel stays booked through Gondola are treated as direct bookings, meaning you’ll still earn all your usual hotel loyalty points, elite night credits, and enjoy your elite-status perks, just as if you’d booked directly with the hotel.

The real standout, though, is the extra return you receive from Gondola. Every reservation booked through the platform earns an additional 3% cash back in the form of Gondola Cash — and that can climb as high as 7% if you hold Gondola status.

In other words, you’re stacking cash back on top of the rewards you’re already earning, giving you even more value to put toward your next hotel stay.

And as part of your early-2026 travel strategy, you'll want to sign up for Gondola now and book any planned hotel stays by the end of January. It's currently offering a limited-time status challenge, which will allow you to earn even more cash back for the year.

Sign up for Gondola and enroll in the status challenge

Refer your friends for credit cards

What if I told you that you could potentially earn up to 200,000 points per year just by recommending your favorite credit cards to your friends?

Many credit cards offer a refer-a-friend option, so you can earn points or miles if a friend applies through your referral link. For example, if you have a Marriott credit card, you'll currently earn 40,000 bonus points for every friend who's approved (and meets the offer terms), so long as your friend applies through your referral link.

That means if you refer 5 friends or family members in a year, you'll get 200,000 Marriott bonus points. Combine that with Marriott's fifth night free benefit, and you could get an amazing 5-night vacation simply by sharing your points knowledge with others.

Just note that referral bonuses, approval odds, and annual caps vary by issuer.

Sign up for every rewards program (and any bonus offers)

Finally, while this might sound obvious, I'm always shocked by how many friends tell me they aren't a member of a loyalty program — even though they just flew the airline last week!

Even if you think you'll never fly a specific airline or stay at a particular hotel chain, enroll in the free rewards program. There's absolutely no reason not to. Yes, it might be a while before those points are worth something to you, but you never know down the line when they'll come in handy.

And once you do sign up for an airline or hotel program, make sure to register for every bonus offer you see. We here at Points Path highlight many of our favorite bonus promotions in our top 5 travel deals every weekend, so make sure to register when those offers cross your inbox.

Gear up your miles for 2026

Now's a great time to lock in the systems that earn points automatically all year. A little planning now can pay off all year long — and even beyond.

Between credit card bonus offers, shopping portals, dining portals, friend referrals, and taking advantage of every extra opportunity possible, your points and miles can add up much faster than you think. Stick with it, and you'll be well on your way to that much-needed vacation — powered almost entirely by your travel rewards.

Snag this must-have pillow for surviving long-haul flights

Step up your travel game with the ultra-comfy EverSnug 2-in-1 Travel Pillow. Lightweight yet warm, this premium microplush blanket is perfect for your next long-haul flight. And with the incorporated carabiner, you can attach it to your luggage or backpack for easy travel.

Get it at Amazon!